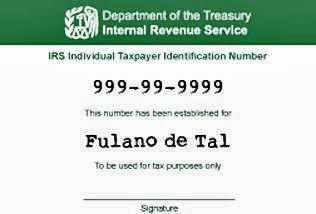

Porter Ranch, CA- Undocumented people who work in the United States are still held accountable for paying taxes. They can apply for individual taxpayer identification numbers, also referred to as ITIN provided by the Internal Revenue Service to pay their taxes.

The IRS assigns this number to individuals who apply through W-7 forms. This allows them to be identified in their status and helps them abide to the same standards that all natural citizens have to comply to.

Applicants must bring in the W-7 forms and a U.S. tax return. They also are asked to bring a passport or two official identification documents like a birth certificate or foreign driver’s license. A list of acceptable identification can be found on the IRS site or on a tax preparation service site like H&R Block.

Immigration status is not affected by receiving an ITIN number. They also do not substitute for work permits. These are available to undocumented individuals that want to comply to the law, but are unable to obtain social security numbers.

Foreign investors in real estate are the most common users of ITIN numbers which allow them to file Federal and State tax returns. The ITIN program was created in 1996 by the IRS to give undocumented people a way to file taxes. If individuals don’t use their number for three years they’ll expire and be reassigned.

Millions of undocumented immigrants now file their taxes each year. The IRS doesn’t usually share taxpayer information with other federal agencies, unless it’s for tax administration purposes or if a federal judge requests it.

Contributions by CNN, Internal Revenue Service, American Immigration Council

Images: WRAL.com

Video: Monica Villacorta

EDUCATE YOURSELF

Fiscal Consequences of Immigration